India's outbound travel landscape has reached an unprecedented milestone. January 2024 saw over 6.52 million Indians journey abroad, a staggering 17% increase from January 2023. This surge is not a mere anomaly but a clear indication of a significant transformation in the country's travel habits and aspirations.

Projections suggest that India’s outbound tourism market will reach a whopping $60 billion by 2031, growing at a compound annual growth rate (CAGR) of 10.9%. By then, an estimated 50 million Indians will be exploring international destinations. Behind these numbers lies a compelling narrative of a nation on the move.

What is Driving India’s Outbound Travel Growth?

This dramatic growth is underpinned by a burgeoning middle class—youthful, tech-savvy, and eager for new experiences.

According to McKinsey, India's outbound travel market is poised to explode from 13 million trips in 2022 to a staggering 80 million by 2024. This phenomenal growth is reshaping the global travel industry, positioning India alongside the United States and China as a dominant force in outbound tourism. A report by Trevolution Group highlights a 37% surge in travel sales within the Indian market, with Online Travel Agencies (OTAs) capturing a substantial share of bookings, thanks to their digital convenience.

Rising personal incomes and increased accessibility are democratising international travel for a broader swath of India's population. The country's extensive global diaspora and international student body continue to attract visits from friends and relatives, contributing significantly to outbound travel. Affluent Indian travellers are also carving out a niche for high-end, personalised experiences, while business travel is set to expand, driven by the Meetings, Incentives, Conferences, and Exhibitions (MICE) sector.

India’s Evolving Travel Potential

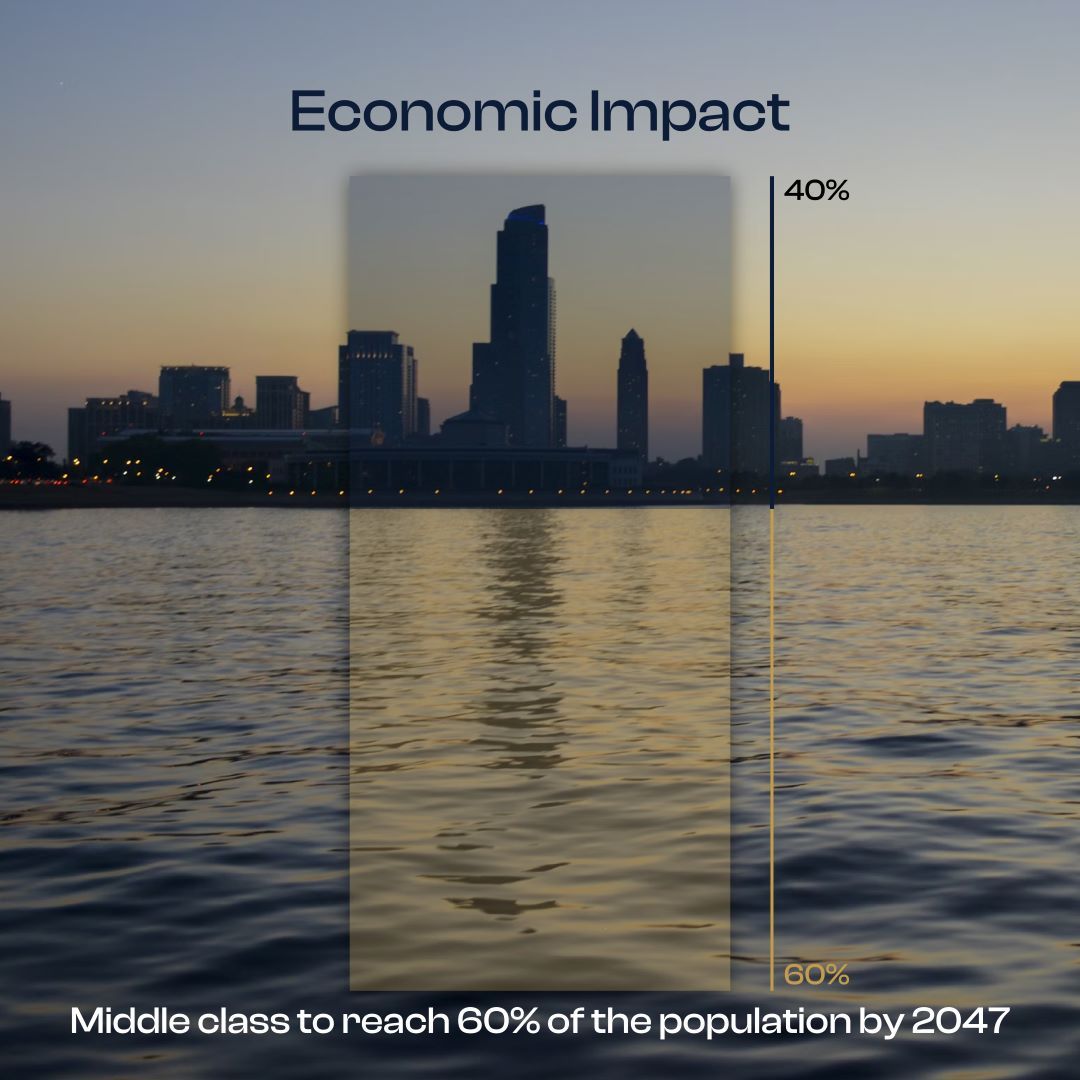

India is expected to become the fourth-largest global spender on travel by 2030. The driving force behind this surge is the expanding middle class, which is growing at an annual rate of 6%. Currently accounting for 31% of the population, this demographic is projected to reach 60% by 2047.

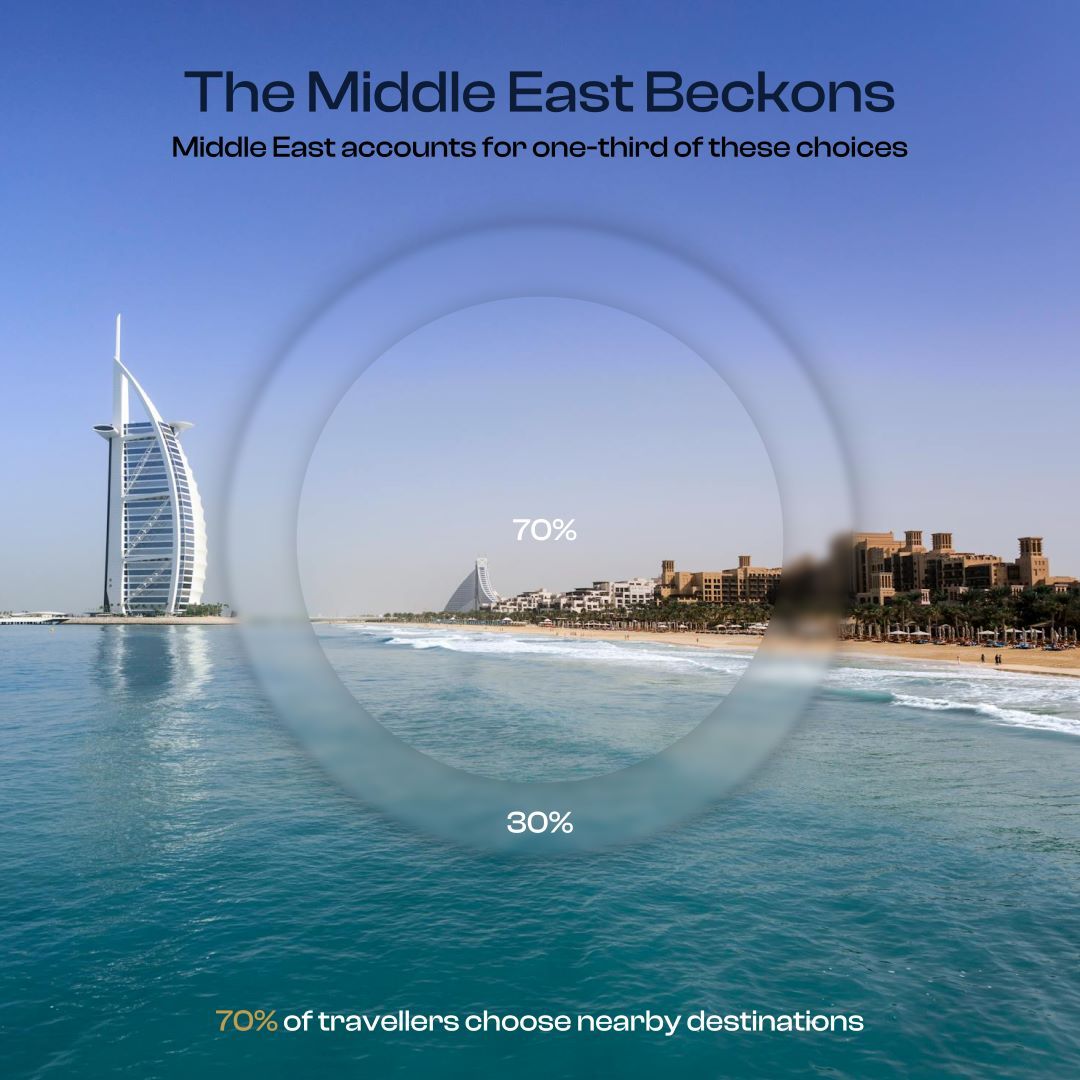

India’s total travel expenditure is set to touch $410 billion in 2030, according to “How India Travels”, the report by Booking.com and McKinsey. 63% of Indian travellers have budgeted to spend more on travel in 2024, says the Skyscanner report. 70% of travellers opt for nearby destinations, with the Middle East representing one-third of these choices, according to a McKinsey report. According to the Directorate General of Civil Aviation, the Middle East and Africa accounted for 58% of India’s outbound international passenger traffic in 2022-23. Overall, experiential travel has moved beyond luxury vacations and is now welcomed by a wide range of travellers.

In the first quarter of 2024, Indian airports witnessed a record 97 million passengers for both domestic and international travel, a stark contrast to a decade ago when such figures would have taken an entire year to achieve. This surge illustrates the rapid development of India's aviation sector and its growing importance in global travel.

As China recovers slowly from the pandemic, partly due to ongoing visa restrictions, India is making significant strides in international travel. The slower recovery from the Chinese mainland has provided India with an opportunity to rapidly increase its presence in various global travel markets.

Visa Exemptions and Favoured Destinations

Indians are increasingly drawn to destinations offering liberal visa policies. Leisure travellers globally are extending their trips, now averaging five days compared to four a decade ago, particularly in countries where local currencies have weakened against the US dollar. Recognising the potential, countries like Thailand, Vietnam, and Sri Lanka have streamlined visa processes and introduced waivers to attract Indian tourists. As the top destination for Indian outbound travellers, Thailand welcomed nearly 1 million visitors between November 2023 and April 2024. According to the Tourism Authority of Thailand, the visa exemption initiative has been pivotal, increasing daily Indian arrivals from 4,000 to 5,500 people. Furthermore, digital transformations in visa applications and strategic roadshows by nations such as Australia, Russia, Saudi Arabia, and Vietnam highlight the global recognition of India's value as a travel market. Vietnam has also emerged as a favoured destination, attracting Indian travellers with its rich culture and relaxed visa policies.

The Asia-Pacific region is crucial for the growth of outbound travel from India. Destinations like Munich, Tokyo, Bali, and Bangkok are set to see increased demand, fueled by major events like the UEFA EURO 2024 football championship and enhanced tourism infrastructure.

The Middle East Beckons Indian Travellers

The Middle East emerges as a preferred destination for Indian travellers, with Dubai leading the charge as the top source market for inbound tourism.

The reopening of Indian skies has led to a surge in flights, with airlines reinstating pre-pandemic frequencies to cater to the demand. With over 8.5 million Indian expatriates currently working in the GCC, business travel and bleisure will undoubtedly underpin this growth. The Arabian Travel Market (ATM) 2024 anticipates record participation, showcasing India's diverse tourism offerings and serving as a platform for innovation and collaboration in the travel industry.

Emerging Trends and Preferences

Indian tourists are increasingly drawn to experience and event-based travel, especially millennials, Gen Z, and young professionals, who seek travel experiences aligned with their hobbies and passions. This includes the rise of sleep tourism, encompassing spa treatments, yoga, and swimming, as well as a growing demand for bespoke private vacations.

For long-haul journeys, destinations like Australia, New Zealand, France, Switzerland, Spain, Portugal, Hungary, and Finland are anticipated to be top choices. Shorter getaways favour bustling destinations such as Singapore, Malaysia, the Maldives, Dubai, Abu Dhabi, Thailand, Indonesia, Saudi Arabia, Ras Al Khaimah, Oman, Hong Kong, Vietnam, and Bhutan. Additionally, mid-way destinations like South Korea, Japan, and Turkey offer compelling options, highlighting the diverse preferences of Indian travellers.

In conclusion, India's outbound travel surge marks a transformative period in the nation's travel landscape, fueled by a dynamic middle class, technological advancements, and evolving travel preferences. As Indians embark on journeys of exploration, the travel industry must evolve to meet their diverse needs and aspirations. This surge not only signifies a remarkable resurgence from the challenges posed by the pandemic but also presents unparalleled opportunities for collaboration, innovation, and growth in the global travel sector. As India's outbound travellers continue to traverse the globe, the industry stands on the cusp of a new era, characterised by boundless potential and a renewed spirit of adventure.

Source: EconomicTimes, ResearchandMarkets, Skift, CurlyTales, TravelWeekly